The S&P 500 is having its worst start to a year since 1939. Almost all major sectors are sitting on year-to-date losses. Fixed income, the traditional ballast of a diversified portfolio, is also off to a historically rough start for the year, the worst since 1842. Treasuries, corporate bonds, and municipals have all declined this year. Holding cash carries its own risk with inflation sitting at multi-decade highs.

Continue readingAuthor Archives: Grace Rohrwasser

Employment Update

Market Minute

May 2022 – Scott Rosenquist, CFA®

The latest employment data release showed continued strength in the U.S. labor market. The number of jobs added in the month of April was 428,000, higher than expectations of 400,000. The unemployment rate held steady at 3.6%, just above the pre-pandemic level of 3.5%. The gains were broad-based led by leisure and hospitality (+78k) where employment there remains down 1.4 million from pre-pandemic levels. What does this mean for monetary policy?

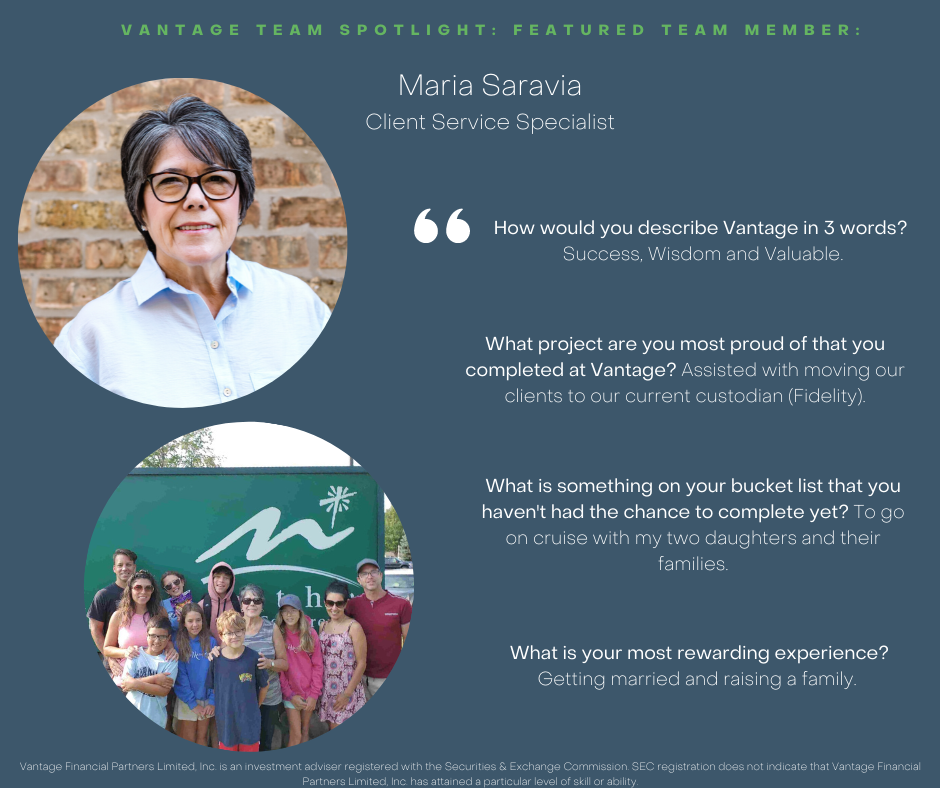

Continue readingVantage Team Spotlight – Maria Saravia

We are thrilled to be featuring Maria Saravia this week in our Employee Spotlight! Maria has been a part of the team for over 13 years! Learn more about Maria here.

Hikes and Tapering

Market Memo

April 2022 – By Kyle Rohrwasser

Russian President Vladimir Putin says peace talks have reached a “dead-end situation” after Ukraine made allegations about war crimes. It seems that war in Ukraine will continue as Russian forces shift their focus toward Donbas. The war is weighing on the global supply chain, especially within the global food supply. The disruption increases the price of the food we eat and the inputs needed to successfully grow that food, such as fertilizer and herbicide. As of the end of last week, 2022 returns for most equity sectors are negative. Energy is a notable standout but unsurprising given the recent global events driving energy prices higher.

Continue reading