Market Minute

September 2024 – By Kyle Rohrwasser

Treasury yields were down 25 basis points at 2 years and were down 19 basis points at 10 years over the last week. As a result, the current 2-year/10-year treasury spread widened into positive territory.

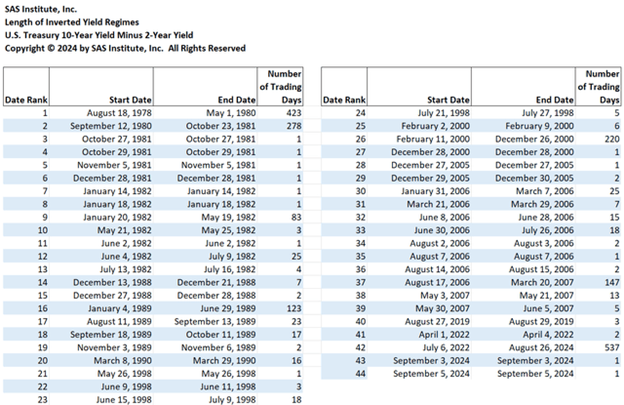

A negative 10-2 spread has predicted every recession from 1955 to 2018, but has occurred 6-24 months before the recession happened, and is thus seen as a far-leading indicator. But this time has been unique in its length as it has been inverted since July of 2022. Historically inversions have lasted 7 months and had a maximum inversion of 65 basis points (0.65%).

With a current inflation rate of 2.9% and the expectation that the shorter end of the curve will move more dynamically than the back end of the curve the goldilocks scenario is still in line. Typically, recession is assisted with higher inflationary numbers and seeing the longer-term rates come down as that is a sign of slower economic growth in the future. We will have to see how it plays out and specifically how the FED reacts to the situation. If the economy can continue to growth while the FED lowers rates, we might find ourselves avoiding any serious recession like we have seen in the past. We will be watching closely as the FED implements their rate cutting plan moving forward.

Investment advice offered through HighPoint Advisor Group, LLC, a registered investment advisor. The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendation for any individual. Although general strategies and / or opinions are revealed, this post is not intended to, nor does it represent or reflect, transactions or activity specific to any one account. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance referenced is historical and is no guarantee of future results. All data and information is gathered from sources believed to be reliable and is not warranted to be correct, complete or accurate. Investments carry risk of loss including loss of principal. Past performance is never a guarantee of future.