Market Minute

October 2023 – By Scott Rosenquist, CFA®

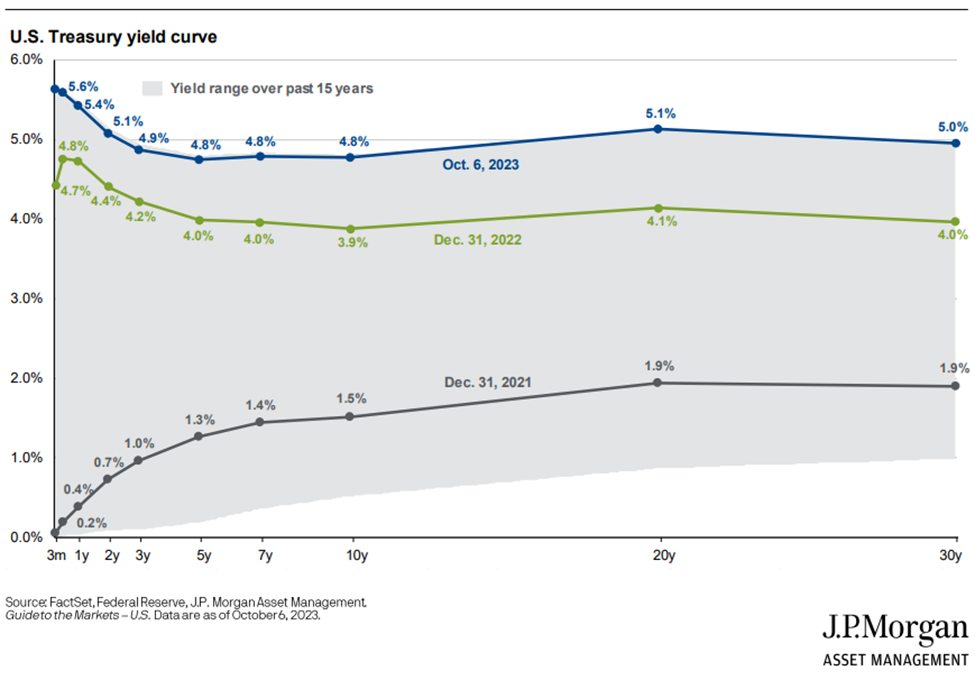

The yields on long-term Treasury bonds have climbed higher over the past few months and even more notably after the last Federal Reserve meeting where interest rates were held steady at 5.25-5.50%. The movement in the bond market highlights that while the Federal Reserve controls the policy rate, which yields on shorter maturity bonds track, longer maturities take more variables into consideration. Economic growth and inflation along with supply and demand are some of the factors priced into longer-term bond yields.

At the last meeting in September, the Federal Reserve updated their summary of economic projections. Expectations for economic growth for the year were revised higher from 1.0% to 2.1% while the unemployment rate projection was lowered from 4.1% to 3.8%. While this looks positive from an economic standpoint and stronger than most had projected earlier in the year, it also reinforces their stance of keeping interest rates higher for longer. The bond market got the memo and adjusted accordingly with yields on longer maturity Treasury bonds moving higher to levels not seen for over 15 years. This is shown in the chart below from J.P. Morgan as longer dated bonds are at or near 5%. Since inflation has come down from its peak last year, interest rates remain higher resulting in tighter financial conditions.

A few other factors are at play, including the supply/demand dynamic for longer-term Treasury bonds. The Treasury department has stepped up bond issuance and their funding plans for next year. This increase in supply is met with some foreign investors not buying as many Treasuries while the Federal Reserve is now reducing their holdings of bonds to unwind the extraordinary support provided at the height of the pandemic. Focus on the U.S. budget is also an issue for investors and debt ratings agencies continue to monitor the political dysfunction that may affect ongoing business in Washington.

The move in yields has brought market volatility across asset classes. While the speed of the increase has been swift, yields are now back near the range of longer-term averages. After significant actions by the Federal Reserve to support the economy through the housing crisis and COVID-19, the bond market is looking to get back to normal.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendation for any individual. Although general strategies and / or opinions are revealed, this post is not intended to, nor does it represent or reflect, transactions or activity specific to any one account. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance referenced is historical and is no guarantee of future results. All data and information is gathered from sources believed to be reliable and is not warranted to be correct, complete or accurate. Investments carry risk of loss including loss of principal. Past performance is never a guarantee of future results.