Market Minute

June 2023 – By Scott Rosenquist, CFA®

Recent commentary from two Federal Reserve officials have increased the odds of a pause on interest rate hikes after their upcoming meeting. This was a sharp change from previous market expectations that another hike could be on the way. Fed Chair Jerome Powell spoke in May and highlighted the significant policy tightening that has taken place and the uncertainty of the lagged effects on the economy. “Having come this far, we can afford to look at the data and the evolving outlook to make careful assessments,” he said. The latest strong employment report did little to change this setup going into next week’s meeting. The Fed chair’s communication will be closely watched for future policy moves including the possibility of resuming hikes in July. Other central banks recently resumed raising rates after a pause.

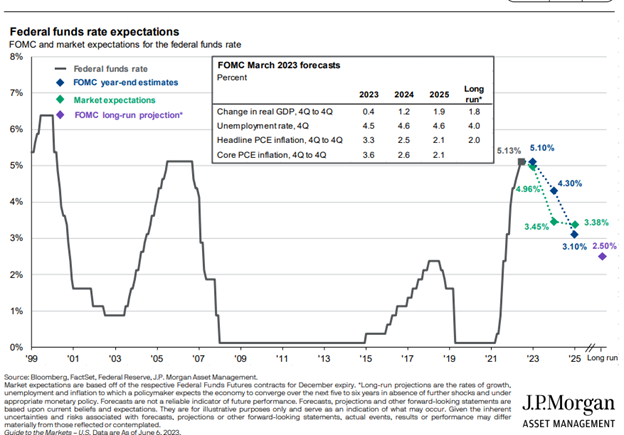

The chart below from J.P. Morgan’s Guide to the Markets shows the current Fed Funds rate and future expectations from the Federal Open Market Committee (FOMC) and market expectations. There was a wide spread between market expectations and the FOMC on the path of interest rates but that gap has narrowed significantly. It also shows FOMC forecasts from March, which will be updated again at the meeting. It is worth noting their 2023 GDP prediction of .4% and what that could mean for the second half of this year. The ongoing strength in the labor market and the resilience of the US consumer have surprised many and allowed for higher rates than the market initially anticipated since the Fed really started moving to tighten policy last year. From here, it looks like the Federal Reserve will take a cautious approach but will leave the door open for more rate hikes if inflation continues to stay elevated and the job market remains tight.

While the lagged impact of policy tightening has not shown up in the economic data in force yet, the reset in the fixed-income markets last year has given fixed-income investors opportunities not seen in years allowing diversification from equity markets and a more balanced portfolio.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendation for any individual. Although general strategies and / or opinions are revealed, this post is not intended to, nor does it represent or reflect, transactions or activity specific to any one account. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance referenced is historical and is no guarantee of future results. All data and information is gathered from sources believed to be reliable and is not warranted to be correct, complete or accurate. Investments carry risk of loss including loss of principal. Past performance is never a guarantee of future results.