Market Memo

September 2024 – By Scott Rosenquist CFA®

The Federal Reserve lowered interest rates last week by a half percentage point in a much-anticipated pivot after holding rates steady since last July. There was debate going into the meeting on the size of the cut and the Fed opted for a larger-than-normal cut to start this rate-cutting cycle.

Fed Chair Powell highlighted the progress made on bringing inflation down to their two percent target while also recognizing cooling in the labor market during the post-meeting press conference. A larger interest rate cut than normal could raise the question of what the Fed sees in the economy and what investors do not. Previous cuts of this magnitude have been in times of crisis, but the current economic data does not support that. During the press conference, Chair Powell said the labor market is in good condition along with the U.S. economy and their intention is to keep it there.

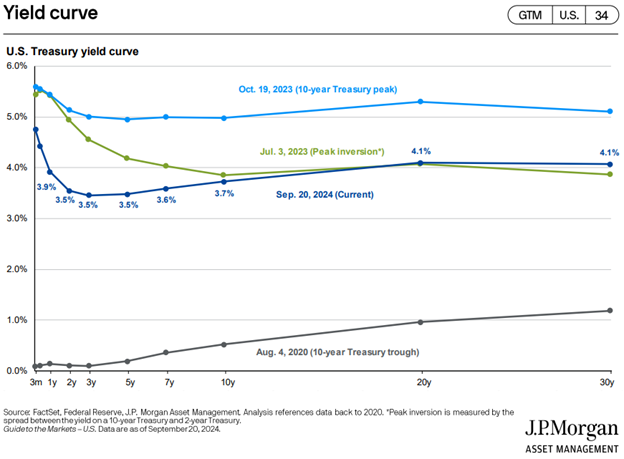

In an update to the Federal Open Market Committee’s economic projections, the forecast for the Federal funds rate for year-end signal additional rate cuts this year and next. The bond market anticipated this move to a degree which is reflected in the chart below showing the yield curve starting to normalize with short rates dropping. The yield curve shows interest rates for a given maturity. In a normal curve environment, shorter maturities have a lower rate than longer maturities resulting in an upward slope. Investors should expect to see lower yields on their cash and cash equivalents over the coming months.

Investment advice offered through HighPoint Advisor Group, LLC, a registered investment advisor. The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendation for any individual. Although general strategies and / or opinions are revealed, this post is not intended to, nor does it represent or reflect, transactions or activity specific to any one account. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance referenced is historical and is no guarantee of future results. All data and information are gathered from sources believed to be reliable and is not warranted to be correct, complete, or accurate.

Investments carry the risk of loss including loss of principal. Past performance is never a guarantee of future results. Vantage Financial Partners Limited is not a tax advisor. Please consult a tax professional for any specific questions regarding your tax situation.