Market Memo

July 2024 – By Kyle Rohrwasser

After being up in the air for the last few years the IRS has finally solidified its rules regarding Required Minimum Distributions “RMDs” and the 10-year rule for beneficiaries. Covid created lots of uncertainty, not only economically but also via tax rulings. Common changes came from the CARES Act that was enacted in March of 2020. Major changes of rules came in the form of extending RMD ages and creating a 10-year distribution rule.

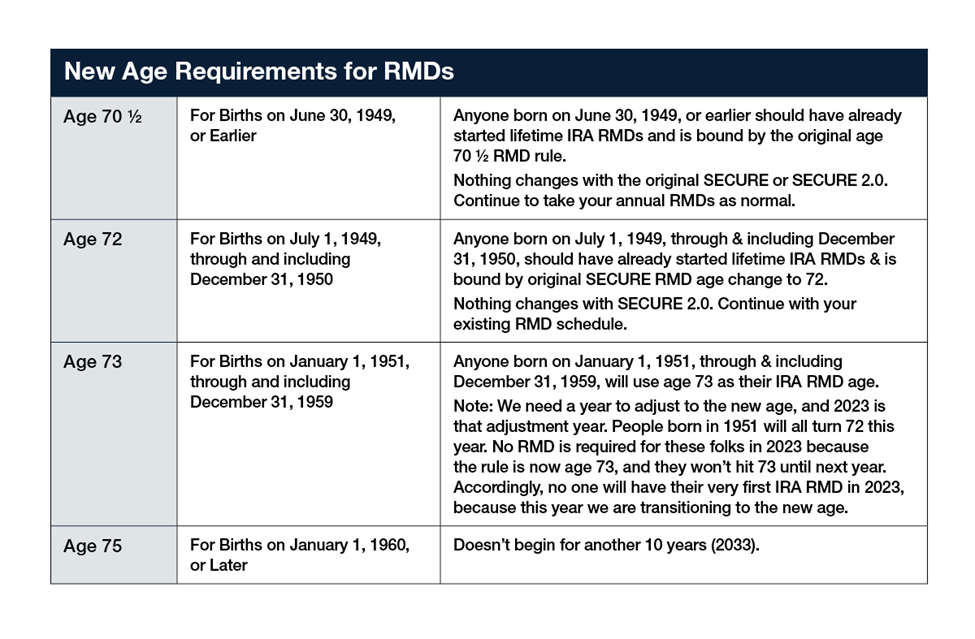

First is the extension of the RMD timing based on age. There is a two-step process under the SECURE 2.0 Act for increasing in the age when RMDs become necessary. Step 1: Beginning in 2023, the age to start taking RMDs jumped from 72 to 73. Step 2: Beginning in 2033, it creeps up again to 75. This change has created unique planning opportunities as it has provided more flexibility on IRA distributions/Roth conversions in the years leading up to the RMD. Below is a breakdown showing the changes based on age.

We finally have been provided clarity on beneficiary Roth IRA rules. “Roth IRA owners have no required minimum distributions during their lifetime, but Roth beneficiaries are still subject to the 10-year rule. But a little advantage if you inherit a Roth: If you’re subject to the 10-year rule, you never have to take years one through nine RMDs, no matter how old you are.”

This is a massive benefit to the beneficiaries of these Roth IRA accounts. They not only do not require a yearly distribution but can continue to grow tax free for another 10 years then be distributed all in the final year. From a planning and estate viewpoint this is a wonderful outcome. It encourages more Roth conversions especially those with children in higher income tax brackets or future estate tax implications.

As we move further into the second half of the year, people should consider tax planning with consideration for Roth conversions before year end. With historically favorable tax brackets and encouraging dynamics of inherited Roth IRAs this may be the opportune time to act.

Investment advice offered through HighPoint Advisor Group, LLC, a registered investment advisor. The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendation for any individual. Although general strategies and / or opinions are revealed, this post is not intended to, nor does it represent or reflect, transactions or activity specific to any one account. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance referenced is historical and is no guarantee of future results. All data and information are gathered from sources believed to be reliable and is not warranted to be correct, complete, or accurate.

Investments carry the risk of loss including loss of principal. Past performance is never a guarantee of future results. Vantage Financial Partners Limited is not a tax advisor. Please consult a tax professional for any specific questions regarding your tax situation.