Market Memo

January 2024 – By Kyle Rohrwasser

Between 2009 and 2022 the average Federal Funds rate for a given year was never over 2.2%, with many of those years averaging well under 1% at essentially zero. That created a situation that we like to call TINA (there is no alternative) which moved most investments into equities. When cash or short-term fixed-income instruments pay very little, one of the only ways to get “real growth” is through the equity markets.

In 2022 we saw the fastest rate hiking cycle in history, pushing equities and fixed income down tremendously. But with rates elevated people have been looking to cash as a diversifier since we are now yielding almost 5%. Sounds great, you can sit in cash with no volatility and earn 5%! Right!? Not so fast…

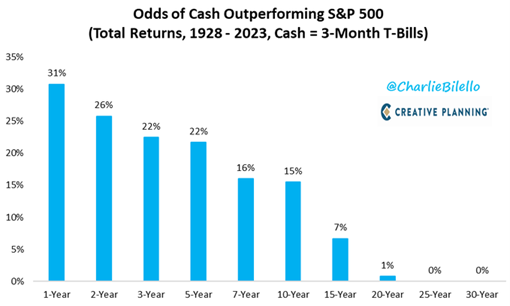

Many investors have moved more to cash because of these circumstances but historically it is only a solution for so long. When we look back over time, the odds of cash outperforming the broad US equity market decreases the longer the time frame stretches. Referring to the chart below you can see how the short-term cash can be a risk-adjusted hedge vs the market but as time progresses your chances of outperformance decrease greatly. Cash outperforms equities in very concentrated, brief periods of time, usually during periods of intense market volatility.

After so many years of cash paying next to nothing, it’s no surprise investors are comfortable holding onto excess cash given that current yield. Cash allows investors to sit out of an increasingly uncertain world. Hiding in cash for too long introduces reinvestment risk and opportunity cost. Reinvestment risk simply refers to the risk that the proceeds are being reinvested at a lower rate, resulting in less total return. Opportunity cost, in this instance, refers to the lost opportunities (lost returns) that pass by while hiding in cash.

A note on opportunity cost. There are countless studies out there that look at historical returns across all asset classes during the rate cycle. Cash performs well during the hikes but sees its yield peak when we hit the pause, the period of time between rate hikes and rate cuts. From that point on, cash typically becomes less attractive relative to other asset classes.

The dynamics have changed in the last few years and created a situation where increasing short-term exposure to cash is valid for certain investors. But the major and most difficult question is when to reallocate capital away from cash. Timing can be avoided by using a diversified approach with small adjustments to accommodate current conditions. Be sure that your portfolio matches your long-term objectives and understand that cash is not a viable investment in the long term. Cash can be king at times but like most kings, their reins of power are short-lived.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendation for any individual. Although general strategies and / or opinions are revealed, this post is not intended to, nor does it represent or reflect, transactions or activity specific to any one account. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance referenced is historical and is no guarantee of future results. All data and information is gathered from sources believed to be reliable and is not warranted to be correct, complete or accurate. Investments carry risk of loss including loss of principal. Past performance is never a guarantee of future results.