Market Minute

January 2024 – By Scott Rosenquist, CFA®

A record amount of cash is now sitting in money market funds as higher yields continue to attract investor attention. This is great news for savers and investors who no longer need to reach for yield by taking additional risk. The question everyone is asking is, how long will it last?

At the last Federal Reserve meeting in December, economic projections for each member were updated showing three interest rate cuts (.75%) this year. While this is no guarantee there will be three cuts, signs are pointing to the end of the rate hiking cycle. Fed Chairman Jerome Powell has noted previously that these projections are just that, projections, and tried to de-emphasize them in press conferences.

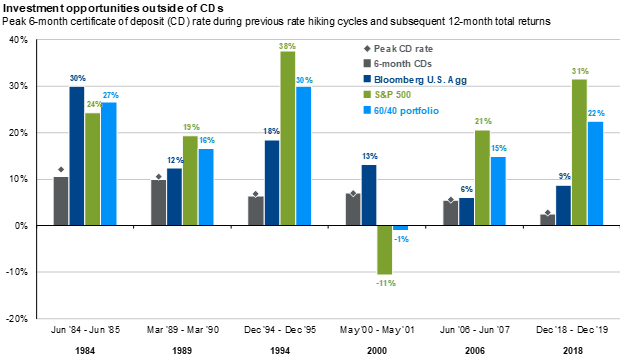

The chart below from J.P. Morgan’s Guide to the Markets shows previous peak rate environments and subsequent returns for different investments. The key takeaway here is that the 6-month certificate of deposit (CD) has historically not been the best choice in this environment. The 6-month CD could be considered a cash equivalent and similar to a money market. This is not to say that short-term safe investments do not have a place in an investor’s portfolio, but they should not be a substantial portion of a long-term portfolio as interest rates peak. Holding an excessive amount of cash in a long-term portfolio ultimately becomes a drag, hurting investors’ chances of reaching their goals.

Source: Bloomberg, FactSet, Federal Reserve, Robert Shiller, J.P. Morgan Asset Management.

The 60/40 portfolio is 60% invested in the S&P 500 Total Return Index and 40% invested in the Bloomberg U.S. Aggregate Total Return Index. The S&P 500 total return figure from the 1984 period was calculated using data from Robert Shiller. The analysis references the month in which the month-end 6-month CD rate peaked during previous rate hiking cycles. CD rate data before 2013 are sourced from the Federal Reserve, whereas data from 2013 to 2023 are sourced from Bloomberg. CD subsequent 12-month return calculation assumes reinvestment at the prevailing 6-month rate when the initial CD matures.

Guide to the Markets – U.S. Data are as of December 31, 2023.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendation for any individual. Although general strategies and / or opinions are revealed, this post is not intended to, nor does it represent or reflect, transactions or activity specific to any one account. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance referenced is historical and is no guarantee of future results. All data and information is gathered from sources believed to be reliable and is not warranted to be correct, complete or accurate. Investments carry risk of loss including loss of principal. Past performance is never a guarantee of future results.