Market Memo

May 2023 – By Kyle Rohrwasser

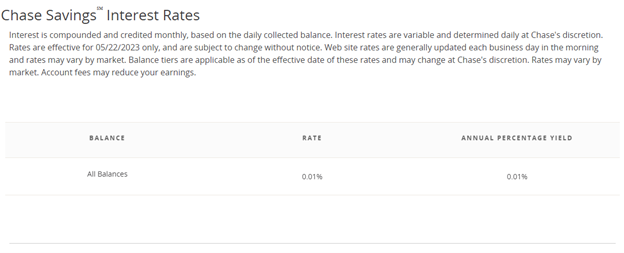

Since February 2022 the Federal Funds rate has increased from 0% to 5%. So, your bank savings account should reflect that in some capacity, right? You wouldn’t expect to get 5% yield on your savings account but if the bank can borrow your money and earn 5% in short term treasuries (considered the safest investment in the world) you assume you would be compensated for letting them use your funds. The answer would surprise you; we are still seeing the historically low interest rates on bank accounts we saw a year ago. I looked up what the Chase Savings interest rates are, and they are basically 0% with the annual percentage yield is 0.01%.

It has become laughable at this point because the banks can take surplus cash (your cash) on hand and hold it overnight with the Federal Reserve at 4.3% annualized or in short-term paper yielding 5+%. For example, the 1-month treasury is yielding 5.6%.

So why doesn’t the bank compensate you while they make off like bandits while you get no interest and lose purchasing power to inflation? The reason is most likely that they do not need to attract new deposits. Historically that was how banks collected deposits, they would compete for your deposits by providing a higher rate to gather market share, at a cost of revenue to them. Sitting with lots of cash from Quantitative Easing over the past 15 years, these large banks are in a position where they don’t need to seek more deposits from consumers allowing them to keep interest rates low for them. That is until enough deposits leave forcing them to provide more incentive to the consumer.

So, what can you do about it? Simply put, at a minimum, move those funds into a money market fund in a brokerage account. You can open an individual (Joint) taxable account for free and invest in a Money Market Fund. These types of money market products invest in extremely short-term debt, so liquidity is extremely high. These products have yields that currently average around 4-5% annually, and can be sold and cash moved into your bank account quickly if you need liquidity.

We still advocate for having a runway of cash setup for emergency spending but excess dollars sitting in your account can be leveraged the same way the bank is leveraging your deposits.

Just to use an example, if you have $30,000 in non-emergency cash in your Savings account you will generate roughly $30/year in interest at .01%. Moving that $30,000 to a short-term money market fund you would earn interest of roughly $1,200-$1,500/year. Those dollars might not make or break your retirement future, but it is still a vacation or debt payment, etc…

We like to think of value in the form of time. The time it takes to set up and utilize these money market funds grossly outweighs the opportunity cost of leaving in your low-interest bank accounts. Something to consider doing while you are compensated for it. Markets will change and adapt in the long term but there is a unique opportunity now to generate something instead of the bank giving you nothing.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendation for any individual. Although general strategies and/or opinions are revealed, this post is not intended to, nor does it represent or reflect, transactions or activity specific to any one account. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance referenced is historical and is no guarantee of future results. All data and information is gathered from sources believed to be reliable and is not warranted to be correct, complete, or accurate. Investments carry a risk of loss including loss of principal. Past performance is never a guarantee of future results.