Market Memo

February 2023 – By Kyle Rohrwasser

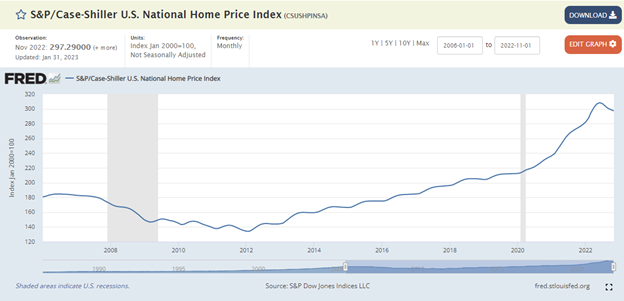

According to the Case-Shiller National Home Price Index, American home values fell roughly 25% from the beginning of 2006 to their bottom in early 2012. Since that low point, average home prices in America have skyrocketed, largely due to low-interest rates, government quantitative easing, and the involvement of large real estate companies purchasing single-family homes as investments. These three major factors created a market where debt was cheap, excess dollars were present in the system, and homes were scarce – a trifecta for increasing real estate values.

Between February 2012 and November 2022, the average home price in America increased by 123%. However, the current scenario is different, and the bullish case for residential homeownership as an investment is fading. These three scenarios have now reversed: mortgage rates are the highest they have been in a decade (the national average as of writing this is 6.75%), the Federal Reserve is now tightening quantitatively (essentially taking dollars out of the market), and large investment firms have stopped buying homes because they have become overvalued. This has created a headwind for real estate, and historically, it is one of the worst times to purchase a home in the last couple of decades. The saving grace currently for housing is the low supply portion of the formula. Pending home sales continue to decrease and home builders are slowing down quickly, this should create a market with very limited supply, essentially creating a buoy for home prices for the time being.

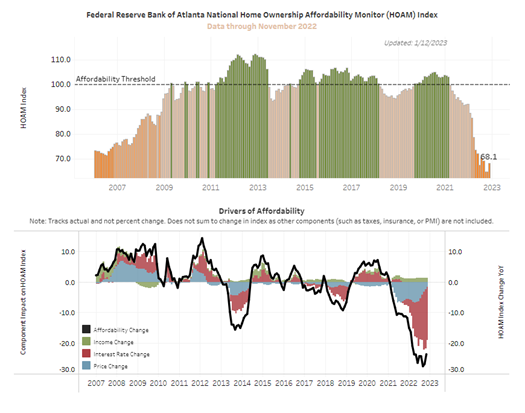

The Federal Reserve Bank of Atlanta tracks and records this data, incorporating it into an index called the Home Ownership Affordability Monitor (HOAM). The chart shows that the current market has low home affordability, the lowest in the last 16 years. The chart also shows the impact on real estate affordability, with most of the impact coming from rising rates. As the Federal Reserve gears up for more rate hikes (estimating three more for 2023 so far), it seems that there may be even more room to fall, and a correction of asset valuations may be in order.

In conclusion, if you are a first-time homebuyer or require a long-term mortgage to purchase your home, you may want to consider waiting for a more opportune time to start. If you are a cash buyer, you may have some opportunities in the coming years in regard to investment. You may see an opportunity similar to 2012 when home prices decreased, and interest rates were cut to increase economic activity. We cannot predict markets, and by no means can we confirm that this will happen, but leading indicators and past cycles have shown the playbook of how the residential real estate market works long term and if over the next few years rates come back down you may have another window of opportunity!

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendation for any individual. Although general strategies and/or opinions are revealed, this post is not intended to, nor does it represent or reflect, transactions or activity specific to any one account. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance referenced is historical and is no guarantee of future results. All data and information is gathered from sources believed to be reliable and is not warranted to be correct, complete, or accurate. Investments carry a risk of loss including loss of principal. Past performance is never a guarantee of future results.