Market Minute

April 2022 – Scott Rosenquist, CFA®

The bond market had its worst quarterly return in decades, down 6% as bond yields rose during the quarter and the Federal Reserve sharpened its focus on inflation. Bond prices move inversely with yields. The unemployment rate now at 3.6%, is near pre-pandemic levels but inflation continues to stay stubbornly elevated. The Federal Reserve raised interest rates by a quarter percentage point after its March meeting, the first-rate increase since 2018, and signaled six more increases for the year. As the Federal Reserve’s plans for fighting inflation became clearer, the bond market responded by quickly adjusting yields higher across the entire curve.

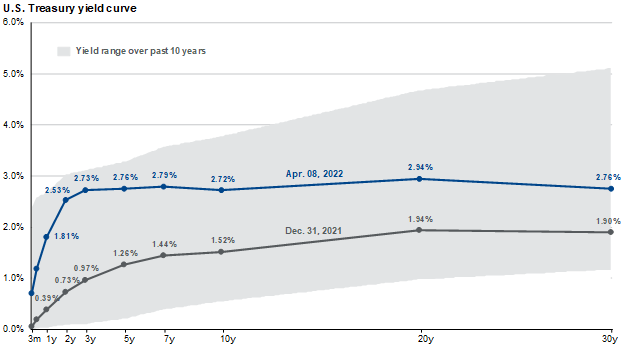

The chart below from J.P. Morgan’s Guide to the Markets highlights the change in the U.S. Treasury yield curve (yields across varying maturities) from year-end and through April 8th. While still low from an absolute level, the rate of change is significant, notably on the front end of the curve. These types of moves can unsettle markets as they rapidly price in the new environment with implications not only for the bond market. Long considered a risk-free asset, Treasury yields are incorporated into the pricing of risk assets including other areas of the bond market and the equity market.

Source: FactSet, Federal Reserve, J.P. Morgan Asset Management. Guide to the Markets – U.S. Data are as of April 8, 2022.

The shape of the yield curve has also flattened and did invert in some areas, meaning longer-dated bonds yield less than shorter maturities. This has been a reliable recession indicator in the past and something we watch closely. Ultimately, higher yields are a good thing for fixed income investors as yields have been so low for a long period of time. The path getting to a more normalized interest rate environment will remain volatile.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendation for any individual. Although general strategies and / or opinions are revealed, this post is not intended to, nor does it represent or reflect, transactions or activity specific to any one account. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance referenced is historical and is no guarantee of future results. All data and information is gathered from sources believed to be reliable and is not warranted to be correct, complete or accurate. Investments carry risk of loss including loss of principal. Past performance is never a guarantee of future results.