Market Minute

March 2022 – Scott Rosenquist, CFA®

Financial markets have been volatile this year as investors watch for updates on the war in Ukraine and clues from the Federal Reserve regarding the future path of monetary policy. This is a lot of uncertainty for the markets to digest causing volatility across global financial markets. The range of outcomes appears wide at the moment, and we hope there is a quick and peaceful resolution. We continue to monitor the situation with the rest of the world.

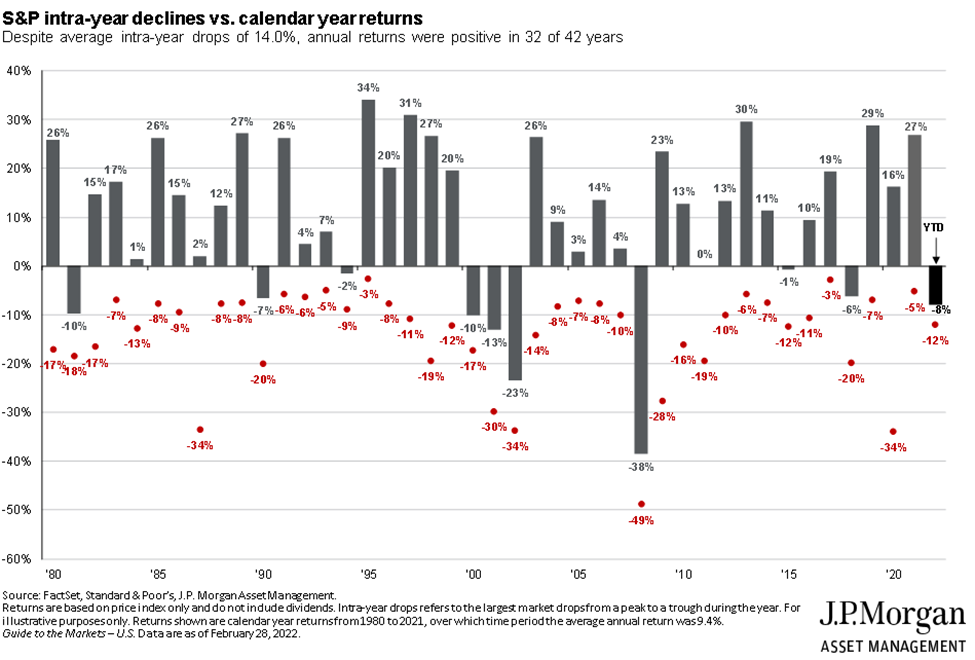

Taking a step back, as hard as that seems during times like this, the chart below from JPMorgan shows historical intra-year declines for the S&P 500 compared to calendar year returns. Volatility is part of investing and looking back shows that investors should expect declines at some point during a given year. The reasons are always different and difficult to know in advance. Last year was unusual with such a high return and low intra year decline as the economy continued to rebound from the pandemic.

Source: FactSet, Standard & Poor’s, J.P. Morgan Asset Management. Returns are based on price index only and do not include dividends. Intra-year drops refers to the largest market drops from a peak to a trough during the year. For illustrative purposes only. Returns shown are calendar year returns from 1980 to 2021, over which time period the average annual return was 9.4%. Guide to the Markets – U.S. Data are as of February 28, 2022.

The situation overseas remains fluid and the implications of removing Russia from the global economy via sanctions will continue to cause volatility notably in the commodity markets. What happens with monetary policy and corporate earnings will ultimately have a more direct impact to investors over the long term.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendation for any individual. Although general strategies and / or opinions are revealed, this post is not intended to, nor does it represent or reflect, transactions or activity specific to any one account. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance referenced is historical and is no guarantee of future results. All data and information is gathered from sources believed to be reliable and is not warranted to be correct, complete or accurate. Investments carry risk of loss including loss of principal. Past performance is never a guarantee of future results.